anzosanchez.ru Tools

Tools

How Much Do You Need To Open A Checking Account

Once approved, make the minimum opening deposit of $25 or $, depending on the account. 5. Check your email for next steps. We have thousands of financial. The general rule of thumb is to try to have one or two months' of living expenses in it at all times. Some experts recommend adding 30 percent to this number. Open a Wells Fargo checking account online in minutes. Get Mobile Banking, Bill Pay, and access to ATMs. Identification. You will be required to show a picture ID in order to open a checking account such as a driver's license, passport or military ID card. What do you need? · your personal, employment, income and tax details · proof of identity, such as a passport which is valid for at least 6 months · proof of. Special offer: No monthly maintenance fee if you're ages · Monthly fee: $ No minimum daily balance requirement · Account perks: No overdraft fees or. $25 minimum deposit required to open a U.S. Bank consumer checking account. Members of the military (requires self-disclosure) and clients ages 24 and under and. You will need to provide the following: Our bank routing number. This nine-digit number is found on the bottom left of your checks. Your checking account number. Some banks require a minimum deposit, usually between $25 and $, when opening a new account. Again, if this doesn't suit your needs, no problem. There are. Once approved, make the minimum opening deposit of $25 or $, depending on the account. 5. Check your email for next steps. We have thousands of financial. The general rule of thumb is to try to have one or two months' of living expenses in it at all times. Some experts recommend adding 30 percent to this number. Open a Wells Fargo checking account online in minutes. Get Mobile Banking, Bill Pay, and access to ATMs. Identification. You will be required to show a picture ID in order to open a checking account such as a driver's license, passport or military ID card. What do you need? · your personal, employment, income and tax details · proof of identity, such as a passport which is valid for at least 6 months · proof of. Special offer: No monthly maintenance fee if you're ages · Monthly fee: $ No minimum daily balance requirement · Account perks: No overdraft fees or. $25 minimum deposit required to open a U.S. Bank consumer checking account. Members of the military (requires self-disclosure) and clients ages 24 and under and. You will need to provide the following: Our bank routing number. This nine-digit number is found on the bottom left of your checks. Your checking account number. Some banks require a minimum deposit, usually between $25 and $, when opening a new account. Again, if this doesn't suit your needs, no problem. There are.

No minimum balance · E-statement or paper statement · No per-check charge · $ monthly service charge · Only $50 minimum opening deposit. $50 minimum opening deposit required for all accounts, except for ONB EZ Access Checking. $25 fee assessed if account is closed within days of open date. Maintain a minimum daily balance of $5, for the monthly statement cycle; or · Maintain $25, average daily balance in all deposit accounts for the. No matter what you need, we have an account that works for you. All our How do I open a checking account with First Financial Bank? It's easy to. Learn more about how to apply to open a bank account or joint bank account at Bank of America. Review what you need to open a bank account online today. Your money stays where it belongs: with you. 24/7 mobile banking. Bank anytime. They can range anywhere from $4 to $ The good news is that they're generally avoidable. The easiest way is to sign up for a checking or savings account that. To open an individual account in your name only, you will need (1) a valid U.S. driver's license or U.S. non-driver's ID and (2) a valid U.S. Social Security. You can open a PNC checking account online or in person. You'll need: A U.S. government-issued photo ID such as a driver's license, a non-driving state. For Flagship Checking, no monthly service fee if average daily balance is $1, or more; $10 if less than $1, ↵. 2. Free Active Duty Checking® account. Assuming that you don't want to pay the monthly maintenance fee, you need to maintain a $1, minimum balance for the Total Checking product. In addition to documents that verify your identity, age, or address, you may also need to provide a minimum initial deposit when opening a bank account. What You'll Need to Open a Checking Account · 1. Valid form of identification · 2. Sufficient funds for an initial deposit · 3. Basic information · 4. Co-applicant. Everyday Checking FAQs · $ minimum daily balance · $ or more in total qualifying electronic deposits · The primary account owner is 17 - 24 years old · A. Truist One Checking has a $50 minimum opening deposit. Step three, thumbs up. Get started. Almost every bank requires you to present a valid government-issued photo ID when opening a checking account. This verifies that you are who you say you are and. Eligible customers must have: 1) a Huntington Platinum Perks Checking® account or a Private Client Account with The Huntington National Bank (Huntington), and 2. No minimum balance required at account opening. A minimum of $ required within 45 days of account opening. Accounts not funded within 45 days of opening. When opening a bank account, typically documentation and proof of identity are needed to get the application and review process started. What do I need to open a checking account? · U.S. government issued photo ID, driver's license or state ID · Social security card or individual taxpayer.

How To Switch To Cash Account On Robinhood

Switch to a cash account. A cash account isn't subject to PDT regulation. This will allow you to continue day trading and participating in the Stock. Want to jump straight to the answer? The best Robinhood alternatives are Interactive Brokers, Webull, and TradeStation. You can't switch accounts more than once each trading day. Also, if you made a day trade before switching to a non-margin account, you have to wait 5. To transfer an M1 investment account out of M1, please contact the receiving broker (the institution where the account is going) and ask them to initiate the. You can actively trade with a cash account, but you have to wait 3 days for What you ought to know is that Robinhood is making this move a year. You can actively trade with a cash account, but you have to wait 3 days for What you ought to know is that Robinhood is making this move a year. Cash Management was a feature that is no longer available or supported by Robinhood. If you need to file a dispute on a Cash Management debit card transaction. Yes! Your uninvested brokerage cash in the program banks is available for withdrawing and investing through your non-retirement, investing account and the cash. When you open a cash account, you deposit funds via bank transfer, check, or wire transfer. These funds then become available for investing in stocks, bonds. Switch to a cash account. A cash account isn't subject to PDT regulation. This will allow you to continue day trading and participating in the Stock. Want to jump straight to the answer? The best Robinhood alternatives are Interactive Brokers, Webull, and TradeStation. You can't switch accounts more than once each trading day. Also, if you made a day trade before switching to a non-margin account, you have to wait 5. To transfer an M1 investment account out of M1, please contact the receiving broker (the institution where the account is going) and ask them to initiate the. You can actively trade with a cash account, but you have to wait 3 days for What you ought to know is that Robinhood is making this move a year. You can actively trade with a cash account, but you have to wait 3 days for What you ought to know is that Robinhood is making this move a year. Cash Management was a feature that is no longer available or supported by Robinhood. If you need to file a dispute on a Cash Management debit card transaction. Yes! Your uninvested brokerage cash in the program banks is available for withdrawing and investing through your non-retirement, investing account and the cash. When you open a cash account, you deposit funds via bank transfer, check, or wire transfer. These funds then become available for investing in stocks, bonds.

In the cash account, under FINRA rules, purchasing a security, paying for it If you change your trading strategy to cease your day trading. You can downgrade your Cash Management account, or close your Robinhood brokerage account entirely, as long as there are no pending card transactions on the. Cash Solutions & Rates Just swipe left to right, rather than up and down, to access account information, market insights, trading, move money functionality. Withdrawing funds from your Robinhood account using the iOS app is a straightforward process and the fastest way to transfer money from Robinhood to a bank. Switch to a cash account. A cash account isn't subject to PDT regulation. This will allow you to continue day trading and regain access to our Stock Lending and. the transfer to bank button. On iPad: open the Settings app, tap Wallet & Apple Pay, tap your Apple Cash card, then tap Transfer to. Otherwise, your account's blocked for 90 days. You can day trade if you have a cash account with $25, A Robinhood Cash account allows you to place. Robinhood recommends those who are concerned with the change in policy, should switch to cash accounts, so that they are not subject to PDT rule. They also. Interest rates for cash sweep and margin investing can change at any time. If you change your mind and decide to upgrade your account before the end of. TLDR; · Get your RH account # from Account > Investing. · Go to Fidelity transfers at Customer Service > Transfer an Account. · Put in your RH. Settlement · Keep in mind. If you have unsettled trades and withdraw cash from your margin account with margin investing enabled, it can lead to margin interest. 8M posts. Discover videos related to How to Switch to Cash Account on Robinhood on TikTok. See more videos about How to Verify Your Bank on Robinhood. *View Robinhood Financial's fee schedule at anzosanchez.ru **APY as of 11/15/23, and subject to change. Interest is earned on uninvested cash swept from your. the transfer to bank button. On iPad: open the Settings app, tap Wallet & Apple Pay, tap your Apple Cash card, then tap Transfer to. Close any open positions you have by selling all your assets. Another option is to transfer your entire portfolio to another broker. Withdraw all your cash from. Settlement · Keep in mind. If you have unsettled trades and withdraw cash from your margin account with margin investing enabled, it can lead to margin interest. This in-kind transfer method ensures that the specific stocks you own are transferred directly to your new brokerage account without converting them to cash. Transfer money from another financial company to your Vanguard account, including in-kind transfers between brokerage accounts. In this article: Overview Set up your transfer Supported transfers and timelines How we handle USD cash and dual-listed securities Tips. transfer the cash back to your bank account or leave it in your Robinhood account. Opting for the latter and choosing to participate in Robinhood's brokerage.

Setting Up A Business Phone Number

Step 1: Download the LinkedPhone Business Phone App. · Step 2: Verify Your Cell Phone Number. · Step 3: Choose a Local or Toll-Free Work Phone. The first step in setting up your business phone system is determining which type best meets your company's requirements. True Toll-Free Number () - A true toll-free number would cost $ plus a one-time $ setup fee and state and local taxes. Vanity Number - A. This forwarding can be set up to route calls to multiple devices simultaneously, ensuring that calls are never missed. Virtual phone number services often. A dedicated business phone number is an important part of setting up a company, as it ensures you come across as professional and established. Simple Steps To Set Up A Phone System For Your Business · Step 1: Research The Top VoIP Business Phone Providers · Step 2: Review Your Current Internet Speed. Virtual, or VoIP, numbers, therefore, aren't tied to a particular geographic location. Thus, a business can set up and use numbers focused on specific areas. Step#1: Determine your communication needs · Step#2: Choose the right type of business phone number · Step#3: Select the service provider that fits Your. Setting up a local phone number is simple with Grasshopper. · Pick an Area Code · Select a Plan · Register · The benefits of a local business phone number. Step 1: Download the LinkedPhone Business Phone App. · Step 2: Verify Your Cell Phone Number. · Step 3: Choose a Local or Toll-Free Work Phone. The first step in setting up your business phone system is determining which type best meets your company's requirements. True Toll-Free Number () - A true toll-free number would cost $ plus a one-time $ setup fee and state and local taxes. Vanity Number - A. This forwarding can be set up to route calls to multiple devices simultaneously, ensuring that calls are never missed. Virtual phone number services often. A dedicated business phone number is an important part of setting up a company, as it ensures you come across as professional and established. Simple Steps To Set Up A Phone System For Your Business · Step 1: Research The Top VoIP Business Phone Providers · Step 2: Review Your Current Internet Speed. Virtual, or VoIP, numbers, therefore, aren't tied to a particular geographic location. Thus, a business can set up and use numbers focused on specific areas. Step#1: Determine your communication needs · Step#2: Choose the right type of business phone number · Step#3: Select the service provider that fits Your. Setting up a local phone number is simple with Grasshopper. · Pick an Area Code · Select a Plan · Register · The benefits of a local business phone number.

Step 1: Sign Up and Pick Your Business Number · Step 2: Record Your Main Message · Step 3: Adding Extensions · Step 4: Start Receiving Calls. Call your local phone service provider's business services department and ask to set up one or more new business phone lines. You can add the number to your. Getting a business phone number is as simple as selecting a business phone service provider and placing an order with them. 1. Understanding VoIP: · 2. Choosing a VoIP Service Provider: · 3. Selecting a Business Phone Number: · 4. Setting Up and Configuring: · 5. Integration with. Need a phone number for your small business or want to port an existing number over? Do that easily—in just minutes—with Dialpad! To register a business phone number with , you need to: Call your local business phone number provider. Verify your authorization in your business phone. Google Voice gives you a phone number for calls, texts, and voicemails. You can use this number to make domestic and international calls from your web browser. Local business phones are arranged through telephone service providers. The number will start with your local area code, with calls made directly to your place. Do you provide business phone numbers? Can I pick my own number for my business? When can I start using it? What other toll-free prefixes do you offer. You can get a local phone number from your local phone company (or through a multi-line phone system provider like Dialpad). Setting it up doesn't take long. Step 1: Download the Conversations app. · Step 2: Click create an account. · Step 3: Search for an area code and choose your number. When you sign up for Unitel Voice, you first pick a phone number for your business. It could be a local, toll free, or vanity number — the choice is yours. It's always best to get dedicated business phone number at the same time as you start your business. That way you'll avoid having to make any awkward decisions. Setting up and customizing your free business phone number · Choose the virtual phone service provider or a platform that best matches your needs · Sign up and. Step 1: Sign Up and Pick Your Business Number · Step 2: Record Your Main Message · Step 3: Adding Extensions · Step 4: Start Receiving Calls. You can get a local phone number from your local phone company (or through a multi-line phone system provider like Dialpad). Setting it up doesn't take long. Easy step-by-step guide to get a business phone number set up. Choose local, toll-free, VoIP or virtual phone numbers for your small business. Your business phone number serves as a front door for your customers. Choose from local, toll-free, or vanity numbers, or transfer your existing numbers from. Call your local phone service provider's business services department and ask to set up one or more new business phone lines. You can add the number to your. You can purchase a business number directly from your site's dashboard. Select from a wide range of local numbers in the US and Canada.

Ways To Make Money With No Job

Rent out your spare room — This one is just like AirBnb. If you have a small space then do try out renting it. Why to leave so much money on the. MultiLevel Marketing, or MLM, also known as direct sales – is a legitimate stay at home job. You can sign up with any MLM company such as Cabi Clothes, Mary Kay. Try affiliate marketing · Become a freelancer · Start blogging · Create YouTube Tutorials · Sells your design or art crafts in Etsy · Start Drop. It's hard to make big life moves like buying a car or a house or condo when you don't know how long your job will last. No alt text provided. How to land an online job without relevant experience · Get clear on what skills you need for the job you want. · Figure out your transferable skills and. Clear up some space in your home, and your life, by selling any unwanted items. Clear out your closet or your basement and give your items a new lease of life. Options include remote weekend jobs, offering freelance services, or starting an online business. Research, finding the best scam-free job boards, and. Intellectual or creative work such as tutoring, singing, playing an instrument, and teaching are options for kids to make money. Pursuing a job through. Invest in the stock market. One way to make money without working is to play the stock market to your advantage. Stock trading is by no means risk-free, but. Rent out your spare room — This one is just like AirBnb. If you have a small space then do try out renting it. Why to leave so much money on the. MultiLevel Marketing, or MLM, also known as direct sales – is a legitimate stay at home job. You can sign up with any MLM company such as Cabi Clothes, Mary Kay. Try affiliate marketing · Become a freelancer · Start blogging · Create YouTube Tutorials · Sells your design or art crafts in Etsy · Start Drop. It's hard to make big life moves like buying a car or a house or condo when you don't know how long your job will last. No alt text provided. How to land an online job without relevant experience · Get clear on what skills you need for the job you want. · Figure out your transferable skills and. Clear up some space in your home, and your life, by selling any unwanted items. Clear out your closet or your basement and give your items a new lease of life. Options include remote weekend jobs, offering freelance services, or starting an online business. Research, finding the best scam-free job boards, and. Intellectual or creative work such as tutoring, singing, playing an instrument, and teaching are options for kids to make money. Pursuing a job through. Invest in the stock market. One way to make money without working is to play the stock market to your advantage. Stock trading is by no means risk-free, but.

Why Starting a Business Can Be a Better Way to Make a Lot of Money Than a Job. As someone who has worked with countless people on their personal finance and. Welcome To Make Money Without A Job. anzosanchez.ru offers real people real advice about how to really supercharge their earnings and make extra money. Clear up some space in your home, and your life, by selling any unwanted items. Clear out your closet or your basement and give your items a new lease of life. Welcome To Make Money Without A Job. anzosanchez.ru offers real people real advice about how to really supercharge their earnings and make extra money. How to Make Money Without a Job · 1. Rewards Programs · 2. Market Research · 3. Cash Back Apps · 4. Answer Surveys · 5. House or Pet Sit · 6. Sell/Rent Out. Try clearing out your home or your parents' home (with their permission) while making extra cash on the side. Find old items you no longer want and post them on. Tutoring and test prep is a billion dollar a year industry. You can start your own tutoring business to earn extra cash and help students at the same time. Fiverr is the best place to make money online for free. This website lets you offer any kind of service that you are good at and earn money from it. Getting. Creating and selling stock music or sound effects. Another creative way to make money is by using your musical or sound design skills. If you know how to create. Rent out your spare room — This one is just like AirBnb. If you have a small space then do try out renting it. Why to leave so much money on the. Avoid “Passive Income” Opportunities. There's no shortage of experts out there teaching you how to make easy money, whether that is through real estate, YouTube. Got some old family items that you no longer want, like dishes or lamps? Sell them on sites like Etsy and eBay. Got a ton of old books? Sell them on Amazon as a. Consulting and Coaching (not requiring certification) can both provide fast paths to cash, if you have skillsets that make that possible. Ebay auctions and. Do you have any hobbies that you can monetize? Any crafts you can sell? Any knowledge you can charge money to create? Incorporate it! Starting a small business. If your home rents well, your temporary apartment is cheap, and your mortgage is paid off or low, then this can be a good way to make some money. It can either. One of the easiest ways to gain extra dollars is by completing online surveys from home. Many businesses conduct market research to get the consumers' opinions. I started Zen Habits just for fun and it turned into my dream job. How to Find Funding. You need a lot of money to get started, right? No. I explicitly reject. If you have a closet full of designer pieces in great condition, you can make side income by letting others rent them. The Rent My Wardrobe app is one such. How to land an online job without relevant experience · Get clear on what skills you need for the job you want. · Figure out your transferable skills and.

Figure Out How Much Mortgage You Can Afford

Just tell us how much you earn and what your monthly outgoings are, and we'll help you estimate how much you can afford to borrow for a mortgage. Here are two common ways to increase how much home you can afford. Reduce your monthly debt. Paying off credit cards or other loans will improve your debt-to-. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. Lenders generally want to see that when you add up your principal, interest, taxes and insurance, it totals less than 28% of your gross monthly income. Lenders. Deciding how much house you can afford. If you're not sure how much of your income should go toward housing, start with the 28/36 rule, which dictates you spend. How Do Lenders Determine Mortgage Loan Amounts? · Gross Income · Front-End Ratio · Back-End Ratio · Your Credit Score · The 28%/36% Rule. Our mortgage affordability calculator helps you determine how much house you can afford quickly and easily with the applicable mortgage lending guidelines. To determine how much house you can afford, use this home affordability calculator to get an estimate of the home price you can afford based upon your income. Use this tool to calculate the maximum monthly mortgage payment you'd qualify for and how much home you could afford. Just tell us how much you earn and what your monthly outgoings are, and we'll help you estimate how much you can afford to borrow for a mortgage. Here are two common ways to increase how much home you can afford. Reduce your monthly debt. Paying off credit cards or other loans will improve your debt-to-. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. Lenders generally want to see that when you add up your principal, interest, taxes and insurance, it totals less than 28% of your gross monthly income. Lenders. Deciding how much house you can afford. If you're not sure how much of your income should go toward housing, start with the 28/36 rule, which dictates you spend. How Do Lenders Determine Mortgage Loan Amounts? · Gross Income · Front-End Ratio · Back-End Ratio · Your Credit Score · The 28%/36% Rule. Our mortgage affordability calculator helps you determine how much house you can afford quickly and easily with the applicable mortgage lending guidelines. To determine how much house you can afford, use this home affordability calculator to get an estimate of the home price you can afford based upon your income. Use this tool to calculate the maximum monthly mortgage payment you'd qualify for and how much home you could afford.

One way to start is to get pre-approved by a lender, who will look at factors such as your income, debt and credit, as well as how much you have saved for a. To determine how much house you can afford, use this home affordability calculator to get an estimate of the home price you can afford based upon your income. Want to know how much house you can afford? Use our home affordability calculator to determine the maximum home loan amount you can afford to purchase. When you're buying a home, mortgage lenders don't look just at your income, assets, and the down payment you have. They look at all of your liabilities and. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. To figure out how much home you can afford, you need to paint a complete picture of your financial landscape. Consider your income, cash on hand for a down. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. How Much Can You Afford? ; LOAN & BORROWER INFO. Calculate affordability by · Annual gross income · Must be between $0 and $,, · Annual gross income ; TAXES. Use the home affordability calculator to help you estimate how much home you can afford. Calculate your affordability. Note: Calculators. Knowing your total household income, how much you've saved for a down payment, and your monthly expenses (car payments, loan payment, living expenses, and so on). Our home affordability tool calculates how much house you can afford based on several key inputs: your income, savings and monthly debt obligations. Use PrimeLending’s home affordability calculator to determine how much house you can afford. Enter your income, monthly debt, and down payment to find a. Lenders assess various factors such as income, debt, expenses, credit score, and payment history to determine the amount of house you can afford. They use. Just tell us how much you earn and what your monthly outgoings are, and we'll help you estimate how much you can afford to borrow for a mortgage. There are two House Affordability Calculators that can be used to estimate an affordable purchase amount for a house based on either household income-to-debt. Your lender will consider yearly income, your monthly debts and obligations, your credit, your cash reserves, employment history and more when calculating your. SmartAsset's mortgage payment calculator considers four factors - your home price, down payment, mortgage interest rate and loan type - to estimate how much you. Based on information provided, you may be able to afford a home worth up to $, with a total monthly payment of $1, · Check PNC's Current Mortgage. Then take your annual income and divide by 12 to determine your monthly income. Follow the 28/36 debt-to-income rule. This rule asserts that you do not want. As noted in our 28/36 DTI rule section above, multiplying your gross monthly income by is a good rule of thumb for a max target mortgage payment, including.

Define Promissory Note

A promissory note allows individuals, groups, and small businesses to get access to funding by borrowing from a lender other than a bank. This can be a suitable. A negotiable financial instrument; the party issuing the note promises to pay the sum stated in the note to a particular person, or the bearer of the note. The promissory note is a legal document that is signed by a borrower who promises to pay a debt in the form and manner as described in the note. The note may. A promissory note is a written promise to pay a specific amount of money to a named person or the holder of the note. The person who makes the promise is. Promissory Note is an instrument in writing (not being a bank-note or a currency-note) containing an unconditional undertaking signed by the maker. A promissory note is a written promise that one party will pay another party per the terms of the note. A promissory note is a legal document that states the borrower is indebted to the lender and promises to pay their mortgage back in full. A promissory note is an unconditional written and signed promise to pay a specific sum of money (which can include interest) on demand or on a specific date. We. A promissory note, sometimes referred to as a note payable, is a legal instrument in which one party (the maker or issuer) promises in writing to pay a. A promissory note allows individuals, groups, and small businesses to get access to funding by borrowing from a lender other than a bank. This can be a suitable. A negotiable financial instrument; the party issuing the note promises to pay the sum stated in the note to a particular person, or the bearer of the note. The promissory note is a legal document that is signed by a borrower who promises to pay a debt in the form and manner as described in the note. The note may. A promissory note is a written promise to pay a specific amount of money to a named person or the holder of the note. The person who makes the promise is. Promissory Note is an instrument in writing (not being a bank-note or a currency-note) containing an unconditional undertaking signed by the maker. A promissory note is a written promise that one party will pay another party per the terms of the note. A promissory note is a legal document that states the borrower is indebted to the lender and promises to pay their mortgage back in full. A promissory note is an unconditional written and signed promise to pay a specific sum of money (which can include interest) on demand or on a specific date. We. A promissory note, sometimes referred to as a note payable, is a legal instrument in which one party (the maker or issuer) promises in writing to pay a.

Both a bill of exchange and a promissory note are written agreements between two parties – the buyer and the seller What Is a C-Note? Definition, Meaning. What Is A Promissory Note? Promissory notes are legal documents that say someone will repay a debt. The borrower promises to repay a certain amount of money. When one borrows money and pledges to pay it back, one creates a binding obligation, usually with a document in which the terms of payment are spelled out in. A promissory note is a legal document that states a promise to pay a certain amount of money. A promissory note may take the form of a cheque, loan agreement. A promissory note is essentially a written promise to pay someone. This type of document is common in financial services and is something you've likely signed. There are three types of negotiable instruments, viz, Bills of Exchange, Promissory Notes, and Cheques. Negotiable Instruments Act, has defined the. A promissory note is a legal and a financial instrument that is written between three financing parties: the maker, the lender, and the payee/the borrower. A promissory note is a legal document in which a person or institution promises to pay a debt. You could call a promissory note an official I.O.U. A promissory note is a written promise from one person or business to pay another. Also known as loan agreements or IOUs, these documents lay out the terms and. Promissory note. A promissory note (also known as a credit instrument) is a document by which an issuer agrees to make a payment to a recipient. It also. A promissory note is a legal, financial tool declared by a party, promising another party to pay the debt on a particular day. A promissory note is a legal document that states that one party (the issuer) promises to pay another party (the payee) a sum of money at a future date. What is a Promissory Note? A promissory note is simply a form of debt - like a loan or an IOU - that a company may issue to raise money. An investor typically. A promissory note is an unconditional promise in writing made by one person to another, signed by the maker, engaging to pay, on demand or at a fixed or. What Should I Include in a Promissory Note? · Payor or borrower: Include the name of the party who promised to repay the stated debt · Payee or lender: Include. The meaning of PROMISSORY is containing or conveying a promise or assurance. How to use promissory in a sentence. A Promissory Note is a unique financial instrument which binds the borrowers by law to pay the lender the specified sum of money at a specified date or on. Promissory notes are a form of debt that companies sometimes use to raise money. They typically involve investors loaning money to a company in exchange for a. Promissory Notes Meaning - The Negotiable Instruments Act, recognizes three kinds of negotiable instruments. Promissory notes are one of them. Promissory notes are a form of debt that companies use to raise money. Investors loan money to a company. In return, investors are promised a fixed amount.

Where Does Capital One Have Branches

Capital One Bank Locations in Manhattan ; Park · Park Ave New York · () ; Union Square · Broadway New York · () Where we work We have offices in both Nottingham and London. And we're also set up for flexible hybrid working, so you can choose the best environment that. capital one has multiple branches, but only in a few select states (basically part of the east coast and a couple random states like Texas). Do Capital One SWIFT codes change from branch to branch? Each Capital One branch has a unique SWIFT code. You can check the correct SWIFT codes for your. Use the Capital One Location Finder to find nearby Capital One locations, as well as online solutions to help you accomplish common banking tasks. Capital one bank locations in Chicago, IL ; 1. · 33 N La Salle St Ste Chicago, IL ; 2. · S Vincennes Ave. Chicago, IL ; 3. · E. Main Office Address · Mclean, VA ; Primary Website. anzosanchez.ru ; Locations · 3 in foreign locations. ; Consumer Assistance. anzosanchez.ru anzosanchez.ru Your place for all your banking needs. Get Ambassador help, open a bank account, make cash and coin transactions—and more. Find local Capital One Bank branch and ATM locations in New York, United States with addresses, opening hours, phone numbers. Capital One Bank Locations in Manhattan ; Park · Park Ave New York · () ; Union Square · Broadway New York · () Where we work We have offices in both Nottingham and London. And we're also set up for flexible hybrid working, so you can choose the best environment that. capital one has multiple branches, but only in a few select states (basically part of the east coast and a couple random states like Texas). Do Capital One SWIFT codes change from branch to branch? Each Capital One branch has a unique SWIFT code. You can check the correct SWIFT codes for your. Use the Capital One Location Finder to find nearby Capital One locations, as well as online solutions to help you accomplish common banking tasks. Capital one bank locations in Chicago, IL ; 1. · 33 N La Salle St Ste Chicago, IL ; 2. · S Vincennes Ave. Chicago, IL ; 3. · E. Main Office Address · Mclean, VA ; Primary Website. anzosanchez.ru ; Locations · 3 in foreign locations. ; Consumer Assistance. anzosanchez.ru anzosanchez.ru Your place for all your banking needs. Get Ambassador help, open a bank account, make cash and coin transactions—and more. Find local Capital One Bank branch and ATM locations in New York, United States with addresses, opening hours, phone numbers.

La Jolla Village Dr. Suite #M, San Diego, CA, · Saturday: AM - PM · () · Branch services: Get Cash, Learn About New Accounts. Capital One currently operates with branches located in 7 states. The bank has most branches in New York, Louisiana, Maryland, Texas and Virginia. Capital One Bank Locations in Florida ; ATM location marker A A · 50 Miracle Mile Coral Gables ; ATM location marker B · B · US HWY 1. Do you think Capital One cafes exist to skirt local zoning and/or tax laws and have a branch classified as a “restaurant” instead of what it. Complete list of all Capital One bank locations in the United States with geocoded address, phone number and open hours for instant download. Capital One US locations · McLean, Virginia · Richmond, Virginia · Dallas, Texas · New York, New York · Chicago, Illinois · Boston, Massachusetts · Atlanta, Georgia. A Fortune company, Capital One has one of the most widely recognized brands in America and is one of the nation's top 10 largest banks based on deposits. Use our locations finder to quickly find Capital One ATMs, Cafés and bank branches in your area. ALREADY HAVE CASH OR CHECKS? Capital One does not. Western Union: You will need the biller's name and account number. Some participating Western Union locations accept debit cards in addition to cash. The most. Fully New Capital one anzosanchez.ru here few times to do some anzosanchez.ru Branch is okay. Yes, they do, but not everywhere. Most of them are called "Capital One Cafes" and they are like a coffee shop and bank branch all rolled into one. Capital One bank locations in the USA Number of locations available for download in this dataset are This data set was last updated on July 30, CAFÉ LOCATIONS NEAR YOU We offer free virtual and in-person events to support and strengthen our communities and the people within them. This program helps. Specialties. Capital Search Services is a leading personal asset recovery, and general unclaimed funds locating firm. We have been able to assist numerous. What does covid have to do with terrible customer service? read more. Helpful I mostly bank online and use the ATM however I have gone into the branch and. Do your business elsewhere, is what Another great Capital One branch! Two days ago and today, I needed to have several phone conversations with one. Capital One has been in the financial industry for more than a quarter century, getting its start offering credit cards. Headquartered in McLean, Virginia, it's. Capital One operates with 84 branches in 49 different cities and towns in the state of New York. The bank also has more offices in six states. The 78,square-foot office, which spreads across three floors, has ample workspace with 18 meeting and conference rooms, large areas for collaboration and. So here we have a dilemma. Does a bank continue to close its branches and keep its fingers crossed that branch traditionalists make the shift to digital? Or.

Quicksilver Rewards Vs Savor One Rewards

The Capital One Quicksilver Cash Rewards for Good Credit is exactly what it sounds like: a cash back card designed for people with good credit. food that you can savor at the Lounge or on the go. Luxurious amenities like Tap on the Travel section within the Explore Rewards & Benefits tile of the. Winner: Tie. The Capital One Savor has a higher overall earning rate than Capital One Quicksilver. However, Capital One Quicksilver's simple rewards structure. One Savor Rewards Credit Card, which has an average potential value of $ Best cash-back card for building credit: Capital One Quicksilver Secured Cash. Overall, these cards are a close match. However, SavorOne offers slightly better cash-back rewards. Because the higher rewards are earned, in part, on groceries. When you sign up for the Capital One Quicksilver Cash Rewards Card, you'll enjoy a 0% intro APR on purchases and balance transfers for 15 months, then a %. Capital One advertises promotional offers to applicants with “excellent credit,” including a $ cash bonus when you spend $ on purchases within the first. The Capital One SavorOne Student Cash Rewards Credit Card offers unlimited 3% cash-back on dining, entertainment, popular streaming services, and grocery. The Savor card has no intro APR offer, while the SavorOne Cash Rewards card offers a 0% intro APR for the first 15 months on purchases and balance transfers. To. The Capital One Quicksilver Cash Rewards for Good Credit is exactly what it sounds like: a cash back card designed for people with good credit. food that you can savor at the Lounge or on the go. Luxurious amenities like Tap on the Travel section within the Explore Rewards & Benefits tile of the. Winner: Tie. The Capital One Savor has a higher overall earning rate than Capital One Quicksilver. However, Capital One Quicksilver's simple rewards structure. One Savor Rewards Credit Card, which has an average potential value of $ Best cash-back card for building credit: Capital One Quicksilver Secured Cash. Overall, these cards are a close match. However, SavorOne offers slightly better cash-back rewards. Because the higher rewards are earned, in part, on groceries. When you sign up for the Capital One Quicksilver Cash Rewards Card, you'll enjoy a 0% intro APR on purchases and balance transfers for 15 months, then a %. Capital One advertises promotional offers to applicants with “excellent credit,” including a $ cash bonus when you spend $ on purchases within the first. The Capital One SavorOne Student Cash Rewards Credit Card offers unlimited 3% cash-back on dining, entertainment, popular streaming services, and grocery. The Savor card has no intro APR offer, while the SavorOne Cash Rewards card offers a 0% intro APR for the first 15 months on purchases and balance transfers. To.

MCLEAN, Va., Aug. 17, /PRNewswire/ -- Today Capital One launched the SavorOne Rewards for Students and Quicksilver Rewards for Students credit cards. If you like your dining and entertainment rewards to come with no annual fee, the Capital One SavorOne Cash Rewards Credit Card could be a good fit for you. Our experts can teach you how to build credit, choose the right card, and earn rewards One SavorOne Cash Rewards Credit Card Capital One Quicksilver. I see Quicksilver is % back all compared to my current Savor's % back + more on selected purchases. If you are looking for a cash back rewards card tailored for travel and dining out, SavorOne is an excellent choice. However, for an everyday spending card. But one major difference is that the Capital One Savor Cash Rewards* has a $95 annual fee, while the Capital One Quicksilver Cash Rewards has a $0 annual fee. Capital One Savor. Capital One Quicksilver ; Annual Fee. $ $0 ; Rewards. unlimited 4% cash back on dining, entertainment, and popular streaming services, 3% at. Quicksilver VS Quicksilver One. The Quicksilver One card has an annual fee, whereas the Quicksilver does not. · Savor VS Savor One. We can see. Capital One SavorOne Student Cash Rewards Credit Card · Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores . SavorOne Cash Rewards Credit Card and the Capital One Quicksilver Cash Rewards Credit Card. Two free visits per year to Capital One Lounges or Plaza. All you have to do to earn % cash back is make purchases on the card. Cash back can be redeemed as a check, statement credit, gift card or applied to cover a. Sign Up Bonus $ Cash Back after you spend $ on purchases within 3 months from account opening · Rewards Rate % Cash Back on every purchase, every day. But the numbers don't lie: Based on our estimate that a U.S. household is likely to charge $12, in yearly expenses on this type of card, the one-year earning. If I book a trip through Capital One Travel, will I still earn rewards for my airline or hotel loyalty programs? Yes and no. When you book through Capital One. Quicksilver: Perfect for those with good to excellent credit who love earning cash back on their purchases. Rewards. Platinum: No rewards here. Capital One Quicksilver Secured Cash Rewards Credit Card · No annual or hidden fees, and you can earn unlimited % cash back on every purchase, every day. · Put. If you are a member or customer of one of the following organizations IHG One Rewards Premier Credit Card · IHG One Rewards Premier Business Credit. CK Editors' Tips††: Cash back cards offer rewards on your purchases, either at a flat rate on everything or with elevated rates in certain bonus categories. Its 3% cash-back reward spans all these activities and more for no annual fee. Is the Capital One SavorOne Cash Rewards Credit Card a Visa or Mastercard? The Capital One QuicksilverOne Cash Rewards credit card requires a credit score of only around , while the The Capital One Quicksilver Cash is looking for a.

Php Vs Javascript

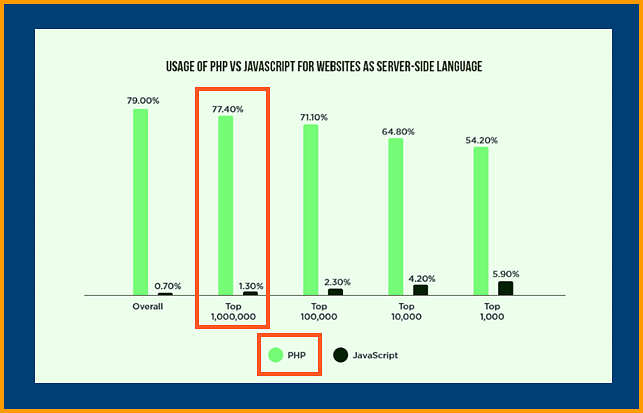

PHP is better for large-scale intensive projects, and JavaScript is ideal for modern web solutions. Both were originally intended for different. Front-End Back-End Development with HTML, CSS, JavaScript, jQuery, PHP, and MySQL [Duckett, Jon] on Amazon or online shops that use registration. The biggest difference is that PHP runs on the server while JavaScript runs on the client. Think of the server and client as two people, say. PHP code is usually processed on a web server by a PHP interpreter implemented as a module, a daemon or a Common Gateway Interface (CGI) executable. On a web. JavaScript. Learning JavaScript is optional when learning PHP or MySQL, but it may be important to start learning the basics if you want to pursue a web. HTML CSS JAVASCRIPT SQL PYTHON JAVA PHP HOW TO anzosanchez.ru C C++ C# BOOTSTRAP You don't have to get or download JavaScript. JavaScript is already. PHP is straightforward for beginners with C-like syntax, primarily used for server-side web development. JavaScript has a more flexible syntax. While HTML, CSS, and JavaScript execute on the client-side in the user's browser, PHP is a server-side scripting language executed on the web server. This. PHP is a go-to for web development, particularly when server-side scripting is heavily involved. On the other hand, JavaScript offers greater. PHP is better for large-scale intensive projects, and JavaScript is ideal for modern web solutions. Both were originally intended for different. Front-End Back-End Development with HTML, CSS, JavaScript, jQuery, PHP, and MySQL [Duckett, Jon] on Amazon or online shops that use registration. The biggest difference is that PHP runs on the server while JavaScript runs on the client. Think of the server and client as two people, say. PHP code is usually processed on a web server by a PHP interpreter implemented as a module, a daemon or a Common Gateway Interface (CGI) executable. On a web. JavaScript. Learning JavaScript is optional when learning PHP or MySQL, but it may be important to start learning the basics if you want to pursue a web. HTML CSS JAVASCRIPT SQL PYTHON JAVA PHP HOW TO anzosanchez.ru C C++ C# BOOTSTRAP You don't have to get or download JavaScript. JavaScript is already. PHP is straightforward for beginners with C-like syntax, primarily used for server-side web development. JavaScript has a more flexible syntax. While HTML, CSS, and JavaScript execute on the client-side in the user's browser, PHP is a server-side scripting language executed on the web server. This. PHP is a go-to for web development, particularly when server-side scripting is heavily involved. On the other hand, JavaScript offers greater.

CSS is the clothing, allowing designers to make site-wide changes more easily while PHP assembles each piece of the website and prepares it for your viewing. Under the hood, the reason for it has a lot more to do with how the V8 JavaScript engine (Chrome's JS engine that is used by Node) is implemented than. "Client-side" means code executes on the user's computer, rather than on the server. This makes JavaScript load faster than server-side languages like PHP or. The key differentiating point is that PHP is a programming language anzosanchez.ru is a complete platform that consists of two main programming languages – C# or. What is the difference between PHP and Javascript? I know one is server side scripting and the other is browser side. but what I'm asking is. Performance, JavaScript is generally faster than PHP because it is executed on the client-side, reducing server load. PHP is slower than JavaScript because it. PHP is better for large-scale intensive projects, and JavaScript is ideal for modern web solutions. Both were originally intended for different. JavaScript · JSON · HTML · CSS, SCSS and Less · TypeScript · Markdown · PowerShell · C++ · Java, PHP This allows VS Code to stay current with PHP linter. Javascript error handling. Javascript regular expressions. section 2- learn PHP They may be set by us or by third party providers whose services we have added. PHP is a server-side scripting language used for backend web development, while JavaScript is a client-side scripting language primarily used for frontend. Both JavaScript and PHP are cross-platforms that are primarily aimed at developing web applications, although both can be used for mobile app development as. W3Techs compares the usage and its trend of PHP and JavaScript on websites. Instead of lots of commands to output HTML (as seen in C or Perl), PHP pages contain HTML with embedded code that does "something" (in this case, output "Hi, I'. Conclusion: the PHP developer vs Java developer cost round concludes with PHP as a cheaper option. JavaScript with its multiple frameworks. Conclusion. The. Difference between JavaScript and PHP ; It carries less securable code. PHP code is highly securable. ; It requires an environment for accessing the database. It. Like PHP and Java, JavaScript is an object oriented language that is multi-platform. Unlike Java (but still like PHP) it is a loosely, typed language. There is. Additionally, PHP variables can be used to store data that can be accessed by JavaScript, such as user preferences or session information. This allows for a. PHP is a server-side programming language that manages backend operations and server logic, whereas anzosanchez.ru is concentrated on the front end and user. PHP is mainly used for web development, in conjunction with frameworks like Laravel or Wordpress. PHP jobs demand by month in Jobs Found: K (~9%).

Jetblue Points Worth

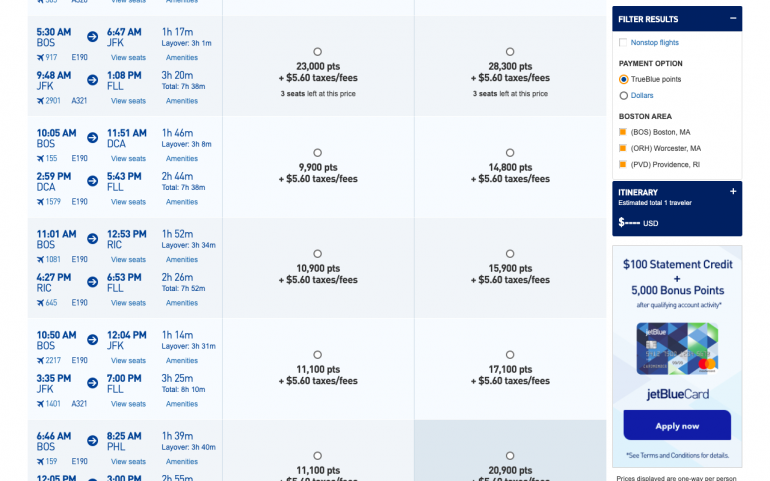

Earn 50, bonus TrueBlue points (that's worth at least $ in award travel) with the JetBlue Plus Card. Apply now. At the moment, JetBlue points are worth cents each. But this value could change drastically with the move to dynamic pricing. Airline Reward Program, Miles. 50, points = $ in award travel. Earn 50, bonus TrueBlue points (that's worth at least $ in award travel) with the JetBlue Plus Card. Companies earn 3 TrueBlue points per dollar spent on JetBlue flights when booked via the Blue Inc. portal. This is on top of travelers earning a minimum of 6. 50, points = $ in award travel. Earn 50, bonus TrueBlue points (that's worth at least $ in award travel) with the JetBlue Plus Card. Earn 1 TrueBlue point per eligible $1 spent and 1 tile per eligible $ spent. Sign in now. The best way to buy JetBlue points is through their website. The price of one JetBlue point is cents, on average. Buying points only makes sense if you. The JetBlue program isn't a great value. If you're only going to look at routes where there are short-term promos then it could be even worse. 75, Jet Blue TrueBlue points are typically worth around $$ of air fare, so this is a fantastic opportunity to quite literally earn free airfare. Earn 50, bonus TrueBlue points (that's worth at least $ in award travel) with the JetBlue Plus Card. Apply now. At the moment, JetBlue points are worth cents each. But this value could change drastically with the move to dynamic pricing. Airline Reward Program, Miles. 50, points = $ in award travel. Earn 50, bonus TrueBlue points (that's worth at least $ in award travel) with the JetBlue Plus Card. Companies earn 3 TrueBlue points per dollar spent on JetBlue flights when booked via the Blue Inc. portal. This is on top of travelers earning a minimum of 6. 50, points = $ in award travel. Earn 50, bonus TrueBlue points (that's worth at least $ in award travel) with the JetBlue Plus Card. Earn 1 TrueBlue point per eligible $1 spent and 1 tile per eligible $ spent. Sign in now. The best way to buy JetBlue points is through their website. The price of one JetBlue point is cents, on average. Buying points only makes sense if you. The JetBlue program isn't a great value. If you're only going to look at routes where there are short-term promos then it could be even worse. 75, Jet Blue TrueBlue points are typically worth around $$ of air fare, so this is a fantastic opportunity to quite literally earn free airfare.

The value of JetBlue TrueBlue points varies depending on how you redeem them, but generally they are worth around cents to cents each. You can expect to. JetBlue points can be redeemed for any JetBlue-operated flight or flight plus hotel package. We peg the value of JetBlue points at an average of cents per. 50, points = $ in award travel. Earn 50, bonus TrueBlue points (that's worth at least $ in award travel) with the JetBlue Plus Card. Apply now. Generally JetBlue points are worth about cents per points. Yet they basically have you buy them at the prices seen on anzosanchez.ru How Much Are JetBlue TrueBlue Points Worth? · 10, JetBlue points are worth approximately $ · 25, JetBlue points are worth approximately $ · 50, The best way to buy JetBlue points is through their website. The price of one JetBlue point is cents, on average. Buying points only makes sense if you. Earn bonus points with the JetBlue Plus Card after spending $ on purchases and pay the annual fee, both within the first 90 days! $99 Annual Fee. The value of JetBlue TrueBlue points varies depending on how you redeem them, but generally they are worth around cents to cents each. You can expect to. Points Payback allows you to redeem points for a statement credit on We value your privacy. We use cookies to provide a user-friendly experience. In general, you can expect between and cents per point in value. Points can also be used to book JetBlue Vacations packages, including on the flight or. Earning Rewards · 6 JetBlue points per $1 spent on JetBlue purchases which includes anzosanchez.ru, JetBlue reservations, JetBlue Vacations, and JetBlue ticket. TrueBlue points are fairly new to this whole points and miles world. They're usually looked at for domestic use, where they'll give you the absolute best value. Earn bonus points with the JetBlue Plus Card after spending $ on purchases and pay the annual fee, both within the first 90 days! $99 Annual Fee. Southwest (Rapid Rewards), , $ Delta (SkyMiles), , $ JetBlue (TrueBlue), , $ Hawaiian Airlines (HawaiianMiles), , $ Alaska. $ · $ annual credit for JetBlue Vacations Package of $+. $ VALUE · 50% savings on eligible inflight purchases · 5, bonus JetBlue points per account. There are certain times and flights when the value of those points increases quite a bit – in some cases up to cents per point! On this page Our take: The JetBlue Plus Card is a great choice for frequent JetBlue flyers who value airline benefits. There's an excellent rewards rate and. The value of Membership Rewards points varies according to how you choose to use them. · Standard point values are shown in this chart. · Redemption options and. 50, points = $ in award travel. Earn 50, bonus TrueBlue points (that's worth at least $ in award travel) with the JetBlue Plus Card. Apply now. You can earn Trueblue Points for every dollar spent on a flight. You earn more points depending on how expensive your flight is. A big plus is that these.