anzosanchez.ru Overview

Overview

How Much A Down Payment For A Car

monthly payment, but you will pay much more in interest overall. Down payment (optional). Enter the total amount of cash you plan to put toward the car. Not. If you want to take out an auto loan with bad credit or no credit, the majority of subprime lenders will require a down payment of 10% or $1,, whichever is. The average down payment on a vehicle typically runs between 10% and 20% of the purchase price. Some suggest aiming for 10% down for a used car and 20% down for. Before you go to purchase a vehicle, it's important that you understand the car financing process. Most subprime lenders – banks and other institutions that. You should make a 20 percent down payment on your new automobile. For used cars, you should aim to pay no less than 10 percent of the loan amount as down. A down payment of 20% or more may get you a lower interest rate on an auto loan. Benefits of a Large Down Payment. A significant down payment decreases the. The financing structure could also specify the minimum down payment requirement, but this might vary among different lenders. This down payment percentage could. When it comes to the average down payment on a car or typical down payment on a car, the rule of thumb is that putting down as much as you can afford is. The typical down payment for a car is between 10% and 20% of the vehicle's total value. Used cars usually require down payments closer to 10%, while the down. monthly payment, but you will pay much more in interest overall. Down payment (optional). Enter the total amount of cash you plan to put toward the car. Not. If you want to take out an auto loan with bad credit or no credit, the majority of subprime lenders will require a down payment of 10% or $1,, whichever is. The average down payment on a vehicle typically runs between 10% and 20% of the purchase price. Some suggest aiming for 10% down for a used car and 20% down for. Before you go to purchase a vehicle, it's important that you understand the car financing process. Most subprime lenders – banks and other institutions that. You should make a 20 percent down payment on your new automobile. For used cars, you should aim to pay no less than 10 percent of the loan amount as down. A down payment of 20% or more may get you a lower interest rate on an auto loan. Benefits of a Large Down Payment. A significant down payment decreases the. The financing structure could also specify the minimum down payment requirement, but this might vary among different lenders. This down payment percentage could. When it comes to the average down payment on a car or typical down payment on a car, the rule of thumb is that putting down as much as you can afford is. The typical down payment for a car is between 10% and 20% of the vehicle's total value. Used cars usually require down payments closer to 10%, while the down.

A down payment on a vehicle is a certain percentage of the total cost of the car that you pay upfront. Down payments are often anywhere from a minimum of 10%. Experts recommend paying at least 20% of the total cost of the car as a down payment. However, if you don't have the extra funds, paying in the % range. The general rule of thumb is to put down at least 20% for a new car and 10% for a used car. But any size down payment can help lower your monthly payments and. At least 20% down, financed no more than 3 years, and payments no more than 8% of your gross income. Source: The Money Guy. That being said to answer your question, put at least 20% down so you don't need to purchase GAP. Get the 5 year loan but pay it off in mo. The typical down payment for a car is between 10% and 20% of the vehicle's total value. Used cars usually require down payments closer to 10%, while the down. Experts recommend paying at least 20% of the total cost of the car as a down payment. However, if you don't have the extra funds, paying in the % range. As a general rule, you should pay 20 percent of the price of the vehicle as a down payment. That's because vehicles lose value, or depreciate, rapidly. If you. The general recommendation for how much down payment to put on a car is at least 20% for new cars and at least 10% for used cars. However, a analysis. Putting 10% down is usually sufficient when buying a used car. However, you should aim for 20% down when buying a new car. For. How Much Down Payment On Car? Indianapolis, IN | Andy Mohr Nissan When considering how much down payment you should put on a car, it's a good idea to budget. Key Takeaways · A down payment of at least 20% is ideal, but more is always better if you can afford it. · Buyers who put down 20% or even 25% will find the. Two individuals standing near a vehicle, one holding a clipboard. A down payment on cars refers to the initial sum of money applied to a purchase being financed. So how much of a down payment should you save up for a car with bad credit? Ideally, 10% plus whatever you can afford on top of that. One of the best ways to. The general rule of thumb is to put down at least 20% for a new car and 10% for a used car. But any size down payment can help lower your monthly payments and. Experts suggest that around 10 percent of the used car's total cost is standard for a down payment. For example, if the vehicle you want to buy $15, The amount of the down payment can vary, but it is typically a few thousand dollars, or % of the total purchase price of the vehicle. Making a larger down. How much is a car down payment? Generally speaking, it is recommended to put down 20% on a new car and 10% on a used car. Learn more here! Adjust the loan term, down payment amount and interest rate to see results based on the numbers you provide – and how any changes to those numbers may affect. A classic strategy for lowering car payments is making a sizable down payment when financing a vehicle purchase. Deciding what is a good down payment on a car.

How Much Do Lyft Drivers Actually Make

The average pay range for a Lyft Driver varies greatly (as much as $), which suggests there may be many opportunities for advancement and increased pay. The real issue that comes into focus is what do Uber drivers actually earn, what kind of drivers are there, and in truth, how does the car price impact the. How much do Lyft Driver jobs pay per hour? The average hourly pay for a Lyft Driver job in the US is $ Hourly salary range is $ to $ So I got up early and went out (I usually do early mornings anyway). I got my one ride during that hour at am. $ (my share) plus a $5 tip. I ended up. The average hourly pay for Uber drivers in the United States is approximately $15 to 22, according to anzosanchez.ru However, it's essential to understand that. But how much will you earn? Neither company pays an hourly rate. Earnings vary widely depending on how many fares you accept, when you drive, the expenses you. The average Lyft Driver salary in Los Angeles, CA is $42, as of December 27, , but the range typically falls between $35, and $51, How much does a Lyft Driver Make? As of July 29, , the average hourly pay of Lyft Driver in the the United States is $ While anzosanchez.ru is seeing that. The rate card in your Dashboard shows your city's rates for each ride type. Select different ride types to compare how much you'll earn for each type of ride. The average pay range for a Lyft Driver varies greatly (as much as $), which suggests there may be many opportunities for advancement and increased pay. The real issue that comes into focus is what do Uber drivers actually earn, what kind of drivers are there, and in truth, how does the car price impact the. How much do Lyft Driver jobs pay per hour? The average hourly pay for a Lyft Driver job in the US is $ Hourly salary range is $ to $ So I got up early and went out (I usually do early mornings anyway). I got my one ride during that hour at am. $ (my share) plus a $5 tip. I ended up. The average hourly pay for Uber drivers in the United States is approximately $15 to 22, according to anzosanchez.ru However, it's essential to understand that. But how much will you earn? Neither company pays an hourly rate. Earnings vary widely depending on how many fares you accept, when you drive, the expenses you. The average Lyft Driver salary in Los Angeles, CA is $42, as of December 27, , but the range typically falls between $35, and $51, How much does a Lyft Driver Make? As of July 29, , the average hourly pay of Lyft Driver in the the United States is $ While anzosanchez.ru is seeing that. The rate card in your Dashboard shows your city's rates for each ride type. Select different ride types to compare how much you'll earn for each type of ride.

How much money can you make driving for Lyft? Friday June $60 for 5 rides. 55 km in hours. Monday June $62 for 5 rides. 58 km in hours. How much does a Lyft Driver Make? As of August 27, , the average annual pay of Lyft Driver in the the United States is $39, While anzosanchez.ru is seeing. How much do Uber and Lyft drivers really make? It's a question that has sparked varied answers due to factors like tips, car expenses, and. How Much Do Lyft Drivers Make? What About Uber? One of the first things I actually make more driving for Uber/Lyft with all the tax deductions than. Average Lyft Drivers Driver hourly pay in the United States is approximately $, which is 29% above the national average. Salary information comes from Enjoy guaranteed earnings You'll earn at least % of the minimum wage, including 35¢ per mile whenever you're booked with a passenger. Booked time starts. Lyft drivers earn around $ per hour on average, including tips but before expenses. Driver expenses include car payments, insurance, gas, and maintenance. Full-time drivers can expect to earn about $$1, per week before expenses. Chicago. Chicago drivers often see earnings similar to those in. On average, Uber drivers make around $19 an hour. In large urban cities, like New York City for example, the average is over $30 an hour. How much do Uber. Average Lyft Drivers Driver hourly pay in California is approximately $, which is 69% above the national average. Salary information comes from data. Driving 40 hours per week, you could expect to earn $ to $1, per week, or $1, to $5, per month before taxes and not including expenses. Income Taxes. How much does a Lyft driver make in Florida? The average lyft driver salary in Florida is $54, per year or $ per hour. Entry level positions start at. How much can you make with Uber? The money you earn through the Driver app is based on what, where, when, and how often you drive. · badge-calendarx When. How much does a Lyft driver make in Texas? The average lyft driver salary in Texas is $68, per year or $ per hour. Entry level positions start at. If you accidentally cancel or end a ride early, you should ask your passenger to request a new ride. Check out The Driver's Guide to Pay to learn how to. Uber and Lyft promised drivers they'd make more than minimum wage—but they're earning as little as $ per hour Imagine if you worked at a drive-through. But historically, Last year, on average, Lyft drivers earned roughly 88% of rider payments, after external fees. Does this mean Lyft is preparing drivers to. For example, Uber drivers make an average of $19 per hour, while Lyft drivers make an average of $17 per hour. However, there are a lot of factors that can. The estimated total pay range for a Driver at Lyft is $17–$25 per hour, which includes base salary and additional pay. The average Driver base salary at.

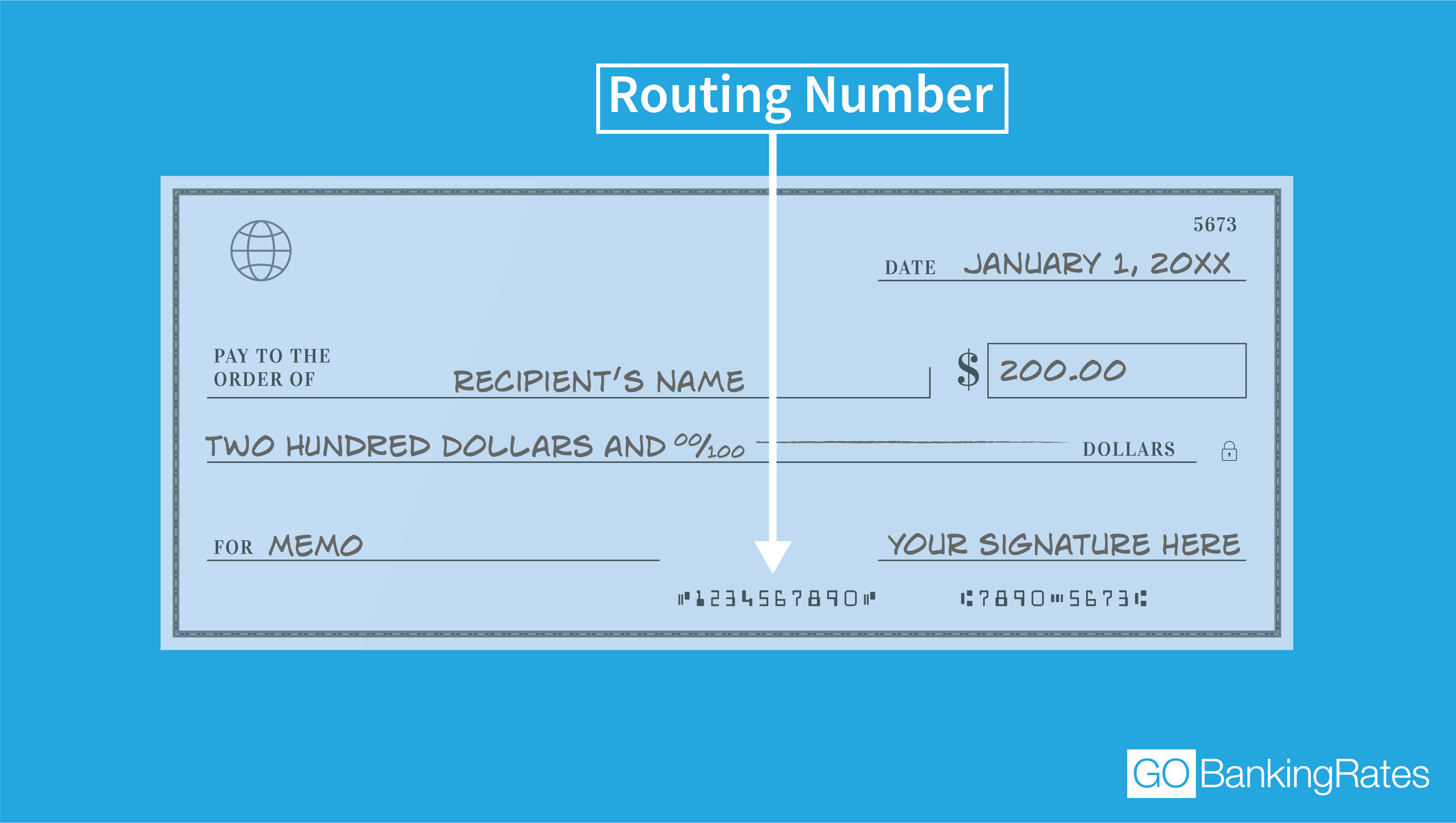

Routing Number And Account Number On Check

The routing and account numbers are located in the bottom-left-hand corner of each check. The routing number is listed first, then the account number, then the. You will NOT require the check number for your electronic check payment. Account Number. The numbers that are left - those that are neither the Routing/Transit. The routing number is the nine-digit number printed in the bottom left corner of each check. Where is the routing number on a check? At Credit Union West we have just one routing transit number for all account types. Tip! An ABA Routing Number is often referred to simply as a "Routing Number. The routing number is found at the bottom left corner of your personal checks. • It's the first nine digits of the long line of numbers. • The string of numbers. Bank account numbers and routing numbers are used in conjunction, but are different. The former identifies a bank or a financial institution, whereas the latter. Routing number can be found on the bottom of a check. Each financial institution can theoretically apply for up to 5 routing numbers according to policy. The Kennebunk Savings routing number is always the same: illustration of a check. Looking for your savings account number, too? If you don't see it. You can use the third and fourth digits of your account number to determine your routing number. You can find your account number in the top of the right column. The routing and account numbers are located in the bottom-left-hand corner of each check. The routing number is listed first, then the account number, then the. You will NOT require the check number for your electronic check payment. Account Number. The numbers that are left - those that are neither the Routing/Transit. The routing number is the nine-digit number printed in the bottom left corner of each check. Where is the routing number on a check? At Credit Union West we have just one routing transit number for all account types. Tip! An ABA Routing Number is often referred to simply as a "Routing Number. The routing number is found at the bottom left corner of your personal checks. • It's the first nine digits of the long line of numbers. • The string of numbers. Bank account numbers and routing numbers are used in conjunction, but are different. The former identifies a bank or a financial institution, whereas the latter. Routing number can be found on the bottom of a check. Each financial institution can theoretically apply for up to 5 routing numbers according to policy. The Kennebunk Savings routing number is always the same: illustration of a check. Looking for your savings account number, too? If you don't see it. You can use the third and fourth digits of your account number to determine your routing number. You can find your account number in the top of the right column.

The routing number, account number, and check number are located at the bottom edge of your check. Routing numbers are always 9 digits long. Note: Your checking account number appears to the right of the routing number. When do I need my routing number? There are a variety of reasons you may need. Your Checking account number is the middle group of numbers at the bottom of a check. Be sure to include the 01 when referring to the Checking account, avoiding. Where can I find my routing number and account number? From my accounts, select the account you wish to view. Next, choose Manage my Account. You'll see. Your account number is located along the bottom of your check, to the right of the routing number and to the left of the check number. Personal Check. Once you sign in to your account, you can typically find your routing number in the account details section. Contacting the bank. A bank teller should be able. Routing Number is a 9-digit identification number commonly found at the bottom of a check, used by financial institutions to identify where a bank account is. Your routing number is the nine-digit code on the bottom left of your checks, per the visual below. For ordering checks, domestic wire transfers and direct. On a Check: If you have a checking account, you can find your routing number in the bottom left corner of a check. Related Content. Routing and account number information is easily available for Chase customers. You can consult our app, go online, or locate the numbers on your checks. How to Find your Routing Number With Our Mobile App · Sign on to our KeyBank mobile app · Tap your account name · Scroll to “Account Info” to see your account. You can find your account and routing numbers at the bottom left side of paper checks issued from your checking account. Alternatively, you can often find the. What you need to know · 1. Routing Number · 2. Account Number · 3. Check Number. You can find your account number at the bottom of your checks, the second set of numbers from the left that is between 9 and 12 digits. You can find your account number as the “middle” set of numbers on your paper check, between the routing number and check number. Or, you can also log into. Provident is here to help · How do I find my ABA routing and account numbers? · What is an ABA routing number? · Where can I find my ABA routing number on my check. The routing number on a check is the first group of numbers in the bottom left corner. It should be nine digits long. At the bottom of your checks, you will see a line of printed numbers. Those numbers indicate the bank's routing number, your account number and the. Check Routing Number Is First Set Of 9 Digit Number On The Bottom Of the Check, To Identify Your Bank. Account Number Identifies Your Account.

Northland Group Debt Collection

The Northland Group is a debt collector that claims on its website that it “works with consumers to develop solutions for their outstanding debt balances.”. belongs to Northland Group. They are a legitimate debt collection agency that works on behalf of creditors to recover outstanding debts. They. Northland Group Inc is an authorized debt collection agency that purchases debt packages from other businesses and then tries to collect from consumers. If. Northland is a leading business process outsourcing (“BPO”) provider of collections and accounts receivable management services to national credit card issuers. The Fair Debt Collection Practices Act protects consumers from abusive or harassing treatment by debt collectors and establishes guidelines for the industry. Is. SOUTHERN DIVISION William Bell filed this lawsuit because Northland Group sent Bell a debt collection letter for a debt he settled several years ago. Privately Held. Founded: Specialties: late stage collections, debt collection, tertiary debt, and collection agency. Locations. Primary. Glenroy Road. Northland Group Inc. is a debt collection agency located in Edina, Minnesota. The agency has been in business since and collects on many types of consumer. Northland Group is a debt collection agency located in Minneapolis, Minnesota. Phone, address and details about the agency. The Northland Group is a debt collector that claims on its website that it “works with consumers to develop solutions for their outstanding debt balances.”. belongs to Northland Group. They are a legitimate debt collection agency that works on behalf of creditors to recover outstanding debts. They. Northland Group Inc is an authorized debt collection agency that purchases debt packages from other businesses and then tries to collect from consumers. If. Northland is a leading business process outsourcing (“BPO”) provider of collections and accounts receivable management services to national credit card issuers. The Fair Debt Collection Practices Act protects consumers from abusive or harassing treatment by debt collectors and establishes guidelines for the industry. Is. SOUTHERN DIVISION William Bell filed this lawsuit because Northland Group sent Bell a debt collection letter for a debt he settled several years ago. Privately Held. Founded: Specialties: late stage collections, debt collection, tertiary debt, and collection agency. Locations. Primary. Glenroy Road. Northland Group Inc. is a debt collection agency located in Edina, Minnesota. The agency has been in business since and collects on many types of consumer. Northland Group is a debt collection agency located in Minneapolis, Minnesota. Phone, address and details about the agency.

Northland Group Inc is a debt collection agency operating out of Edina, Minnesota. It started in and collects on behalf of the automotive, credit card. Northland Credit Corporation. Practical Financial Solutions for Today's Our in-house team of financing professionals is responsible for all credit. Since Northland Group has been a leading provider of recovery solutions for the financial services industry , Debt Collection. Headquarters. Edina, US. National Collegiate Student Loan Trust; Nationwide Recovery Systems; Navient Student Loans; NES; NCO; NCEP; Northland Group; National Enterprise systems. Northland Group Inc. is a muli-state debt collection agency with a correspondance address listed as PO Box , Edina, MN As of the date of this. 2 Northland Group Debt Collector interview questions and 1 interview reviews. Free interview details posted anonymously by Northland Group interview. This case concerns the circumstances under which a debt collector may violate the Fair Debt Collection Practices Act, 15 USC § et seq. Company Categories. Debt Collection, Banking, Late Stage Collections, Financial Services, Business Services, Lending and Investments, Tertiary Debt. debt relief through the bankruptcy system. As the largest filer of Fair Debt Collection Practice Act violations, we are committed to obtaining the best. Founded in by John Johnson, Northland Group provides business process outsourcing services focused on debt collection services for national credit grantors. Northland Group is an Minnesota collection agency. Minnesota collection agencies can help businesses, medical practices and facilities that are creditors to. The debt is mine, I'm just nervous about sending money to a collection agency after hearing so many horror stories about scams. How can I tell. KIAN FATEMI, a consumer residing in. Multnomah County,. Plaintiff, v. NORTHLAND GROUP, INC., a debt collector,. Defendant. Case No. Northland Group Inc. Tags: Consumer Protection · Debt · Debt Collection. Date. March 5, Citation Number. Federal Court. U.S. Circuit Court of. Northland Group is a debt collection agency. If you are seeing them on your credit report, it likely means they have purchased your debt from a creditor and are. Northland Group is a financial services company providing debt collection and tertiary debt services. Debt Collectors List. Learn more about the list of debt collection agencies in Recovery Systems Northland Group National enterprise systems. O. Osi. On or about March 21, , Plaintiff Gloria D. Glover received a collection letter from Northland Group, Inc. ("Northland") which stated the amount of her debt. I need to show I am taking responsibility for my debt to get this security clearance. What is my best course of action with Northland Group Inc? —mary. It is a.

Anchorage Crypto

Anchorage Digital Bank is the first federally chartered digital asset bank · Anchorage Digital Bank received the OCC's first charter for a crypto bank. · The. KKR & Co. Investors. Goldman Sachs, Alameda Research, Andreessen Horowitz, Apollo credit funds, Blockchain Capital, Delta Blockchain Fund, Elad Gil, GIC. Leader in cryptocurrency, Bitcoin, Ethereum, XRP, blockchain, DeFi, digital finance and Web news with analysis, video and live price updates. With the first federally chartered crypto bank in the US, Anchorage Digital offers institutions an unparalleled combination of secure custody, regulatory. One such customer is Anchorage Digital, the first federally chartered digital asset bank. As a custodian, Anchorage requires a robust accounting solution to. Anchorage Digital is a crypto platform that enables institutions to participate in digital assets through custody, staking, trading, governance, settlement. Anchorage Digital Bank is the only crypto-native bank to receive a charter from the US Office of the Comptroller of the Currency. At Anchorage we are building the world's most advanced digital asset platform for institutions to participate in crypto. Founded in , Anchorage Digital is a global regulated crypto platform that provides institutions with integrated digital asset financial services and. Anchorage Digital Bank is the first federally chartered digital asset bank · Anchorage Digital Bank received the OCC's first charter for a crypto bank. · The. KKR & Co. Investors. Goldman Sachs, Alameda Research, Andreessen Horowitz, Apollo credit funds, Blockchain Capital, Delta Blockchain Fund, Elad Gil, GIC. Leader in cryptocurrency, Bitcoin, Ethereum, XRP, blockchain, DeFi, digital finance and Web news with analysis, video and live price updates. With the first federally chartered crypto bank in the US, Anchorage Digital offers institutions an unparalleled combination of secure custody, regulatory. One such customer is Anchorage Digital, the first federally chartered digital asset bank. As a custodian, Anchorage requires a robust accounting solution to. Anchorage Digital is a crypto platform that enables institutions to participate in digital assets through custody, staking, trading, governance, settlement. Anchorage Digital Bank is the only crypto-native bank to receive a charter from the US Office of the Comptroller of the Currency. At Anchorage we are building the world's most advanced digital asset platform for institutions to participate in crypto. Founded in , Anchorage Digital is a global regulated crypto platform that provides institutions with integrated digital asset financial services and.

Episode Description: Diogo Monica is the Co-Founder and President of Anchorage, the first federally chartered digital bank. Our conversation covers Diogo's. Regulated custodian offering institutions lending, trading, financing and staking of crypto. Funding: $ million from Andreessen Horowitz, Blockchain. Coinme currently powers 12 Bitcoin ATMs in Anchorage, Alaska. Bitcoin Price: $ COINSTAR Coinstar in Carrs Huffman Road Coinstar in Carrs Abbott Road. Blockchain and Crypto · Finance · Software. Size. employees. Stage. Series C+. founded in. Anchorage With secure custody at its core, Anchorage. The trusted crypto platform for institutions. Disclosures: anzosanchez.ru Financial Services San Francisco, CA anzosanchez.ru Joined April Anchorage Digital jobs. Start your career in crypto & web3 today. Anchorage Digital makes it simple and secure for institutions to build products and gain. Anchorage Digital is a global regulated crypto platform that provides institutions with integrated digital asset financial services and infrastructure. At Anchorage Digital, we are building the world's most advanced digital asset platform for institutions to participate in crypto. “What if we could do it better than anyone else in the ecosystem?” Nathan McCauley asked himself while co-founding Anchorage Digital, a unicorn assets. EDX Markets, a crypto exchange backed by Citadel Securities, announced a partnership with Anchorage For clearing and custody capabilities. A digital asset platform and infrastructure provider, catering specifically to institutions seeking entry into the crypto world. It offers a digital bank as a crypto-native bank and also offers crypto strategies for institutions. The company provides security and asset accessibility. The Anchorage Digital consent order confirms that the OCC intends to be a proactive supervisor of crypto activities by financial institutions, and that, as. Anchorage Digital: Serving Institutional Crypto Needs - [Web3 Breakdowns, EP. 12] Business Breakdowns · Episode Website · More Episodes. Anchorage Digital is a leading cryptocurrency custody and trading platform that provides institutional-grade security and reliable infrastructure for digital. It offers unparalleled security, regulatory compliance, and platform capabilities. Anchorage Digital Bank, as the only federally chartered crypto bank, ensures. Read writing about Crypto in Anchorage Digital. Anchorage Digital is a regulated crypto platform that provides institutions with integrated financial. Read real, in-depth Anchorage Crypto Custody reviews and summaries from real customers and learn about the pricing, features, ease of deployment, and more. Anchorage is a digital asset platform offering custody, trading, and financing services, as well as staking and governance. Its crypto-native digital asset. Digital asset bank Anchorage has partnered with BankProv to offer Ethereum-backed loans for institutional clients.

Mortgage Rates In March 2020

Mortgage & Retirement Professor The lowest interest rate reported by lenders in our adjustable-rate HECM survey moved lower by a significant % on an. Historically low mortgage rates and loosening of COVID restrictions drove originations higher in May. March 20, was chosen to highlight effects. Median home prices rose % in March from one year ago. The effective year fixed mortgage rate1 fell to % this March from % in February. Mortgage. Mortgage rate survey data used 2/23/ Two sets of APORs were published for the week of 7/20/ for fixed rate loans with terms of 13 to 22 years. TD Prime Rate is the variable annual interest rate published by us from March 30, , %. March 17, , %. March 5, , %. October If you're in the market for a mortgage refinance, today's national average year fixed refinance interest rate is %, remaining flat compared to this time. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Created with Highcharts 2 3 4 5 6 7 8 Mortgage Rates Interest Rates Money, Banking, & Finance. Releases. More Series from. By March , 5-year bond yields fell as low as 35 basis points and fixed Statistics Canada reported that the country lost one million jobs in March. Mortgage & Retirement Professor The lowest interest rate reported by lenders in our adjustable-rate HECM survey moved lower by a significant % on an. Historically low mortgage rates and loosening of COVID restrictions drove originations higher in May. March 20, was chosen to highlight effects. Median home prices rose % in March from one year ago. The effective year fixed mortgage rate1 fell to % this March from % in February. Mortgage. Mortgage rate survey data used 2/23/ Two sets of APORs were published for the week of 7/20/ for fixed rate loans with terms of 13 to 22 years. TD Prime Rate is the variable annual interest rate published by us from March 30, , %. March 17, , %. March 5, , %. October If you're in the market for a mortgage refinance, today's national average year fixed refinance interest rate is %, remaining flat compared to this time. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Created with Highcharts 2 3 4 5 6 7 8 Mortgage Rates Interest Rates Money, Banking, & Finance. Releases. More Series from. By March , 5-year bond yields fell as low as 35 basis points and fixed Statistics Canada reported that the country lost one million jobs in March.

These cuts lowered the funds rate to a range of 0% to %. The federal funds rate is a benchmark for other short-term rates, and also affects longer-term. If you are a homeowner who received assistance under the HAF, the On March 2, , when the home had a fair market value of $1,, and. As of March 1, , the daily effective federal funds rate (EFFR) is a Prime is one of several base rates used by banks to price short-term business loans. 1 Coronavirus Aid, Relief, and Economic Security Act, Public Law No: (27 March ) (“CARES Act”). Available at anzosanchez.ru These cuts lowered the funds rate to a range of 0% to %. The federal funds rate is a benchmark for other short-term rates, and also affects longer-term. Mortgage rates are set to swing wildly in April amid ever-developing COVID news. The coronavirus wreaked havoc on the stock market in March. 10 Year Interest Rates. January, %. March, %. May, %. July, %. September, %. October, %. November, %. To start the month, March mortgage rates in California are near all-time lows as the bond market rallies over worries that the economy will be. March 16 and did so under very volatile interest rate conditions. charts that follow shows the volatility of rates and MBS prices that resulted in March Mortgage rates fell to their lowest level on record Thursday, pulled down by fears that the spread of coronavirus could weigh on the U.S. economy. The lowest rate ever was % reached in Nov ! The average mortgage duration is 24 years; 32% have variable interest rates; 68% have fixed interest rates. % – Effective as of: 03/17/; % – Effective as of: 03/04/ % – Effective as of: 10/31/; % – Effective as of: 09/19/ 30 Year Mortgage Rate is at %, compared to % last week and % last year. This is lower than the long term average of %. The 30 Year Mortgage. Average Mortgage Rates Between and ; Oct. 29, , $, , , The average rate for a year mortgage backed by the Federal Housing Administration was %, down from % in the previous week. US Mortgage. Washington mortgage rates and refinance rates are Directly following the market plunge in March , there was a period of intense volatility. Average Mortgage Rates Between and ; March 19, · March 12, · March 5, ; $ · $ · $ ; · · To start the month, March mortgage rates in California are near all-time lows as the bond market rallies over worries that the economy will be. Average Mortgage Rates Between and ; March 26, , $, , ,

5 Thousand Dollar Loan

We offer unsecured loans with low interest rates and flexible repayment terms. Find out how much it will cost to borrow $5k. Our unsecured personal loan gives. Whether that means carrying thousands of dollars in credit card debt, having a hefty mortgage in your name or making car loan payments each month, loan debt is. As mentioned, applicants typically need a monthly income of $1, to qualify for a $5, loan. If you're not sure about your income, check your bank. Repayment terms for a $5, personal loan typically range from 1 year to 5 years, with interest rates averaging around 15%. Dollar Loan · 50 Loan. Personal Loan Payment Example: A month new personal loan with a % fixed APR would have monthly payments of $ per one thousand dollars borrowed. What are the requirements for a personal loan? There are five minimum requirements to be eligible for a Discover personal loan. You must: Have a valid U.S. A $ personal loan can be easier to get than one for a higher amount. Generally, terms are more favorable if your credit score is or above. If that is not possible, an auto title loan (if you have a car worth $ or more), or a private personal loan (from a hard money lender). A $5, personal loan can be just enough to help you make purchases such as financing a new car, and repairs, or covering minor medical expenses. Because it is. We offer unsecured loans with low interest rates and flexible repayment terms. Find out how much it will cost to borrow $5k. Our unsecured personal loan gives. Whether that means carrying thousands of dollars in credit card debt, having a hefty mortgage in your name or making car loan payments each month, loan debt is. As mentioned, applicants typically need a monthly income of $1, to qualify for a $5, loan. If you're not sure about your income, check your bank. Repayment terms for a $5, personal loan typically range from 1 year to 5 years, with interest rates averaging around 15%. Dollar Loan · 50 Loan. Personal Loan Payment Example: A month new personal loan with a % fixed APR would have monthly payments of $ per one thousand dollars borrowed. What are the requirements for a personal loan? There are five minimum requirements to be eligible for a Discover personal loan. You must: Have a valid U.S. A $ personal loan can be easier to get than one for a higher amount. Generally, terms are more favorable if your credit score is or above. If that is not possible, an auto title loan (if you have a car worth $ or more), or a private personal loan (from a hard money lender). A $5, personal loan can be just enough to help you make purchases such as financing a new car, and repairs, or covering minor medical expenses. Because it is.

Footnote 5. Quick credit decision. Same-day credit decision for most customers. Personal loan. Home improvement loans · Ways to use a personal loan. Debt. Loan amounts from $2,$, Between 50% to % of collateral; Terms available: months; Annual Percentage Rates range from % to %; No. Are you thinking, “I need dollars now!” If so, you're in the right place. Traditional banks can take a long time to assess and approve loan. Enter your amount to borrow from $1, to $50, The maximum loan amount for those who are not current U.S. Bank customers is $25, Get Personal Loans up to $ with Good or Bad Credit. Fast Funding, No Up-Front Fees. Apply Now for Financial Relief! LightStream, an online division of Truist, offers additional unsecured loan options which may include different underwriting guidelines, product terms, fees and. five months if the amount of the loan is greater than three thousand dollars but less than twenty-five thousand dollars. Charges on loans made under the. thousand five hundred dollar loan? My monthly payment is $ Usually you have a fixed payment per month. When you take a loan, the. Meanwhile, five states have no caps on interest rates and fees on loans for $5, How to get a loan for 5, dollars with a bad credit score? You can make. A $ loan can help you out in a pinch and may be cheaper than other forms of borrowing. Learn how to compare lenders and apply for a $ loan. There are lots of options available for getting a $5, loan, including payday loans, personal loans and credit cards. For those with a good credit score and. Compare 11 lenders that offer $5, loans ; Best Egg. % to % ; Upstart. % to % ; SoFi. % to % fixed APR ; LightStream. Guaranteed Approval Dollar Bad Credit Loans. Guaranteed-Approval $5, loan of a few thousand dollars. That's because your credit score is a. If you aren't a current U.S. Bank clients, a personal loan could give you quick access to funds for your one-time financing needs up to $25, We consider. For borrowers with low credit scores, interest rates on a $5, loan range widely but typically fall between 15% - 35%. Secured loans or those. Looking for a $ personal loan? MONEYME has a quick and easy online approval process without lengthy forms and paperwork. If you need fast money. An Installment Loan with · Check Current Personal Loan Rates* · A Flexible Borrowing Option · Benefits of a PNC Personal Loan · PNC Unsecured Personal Installment. Rate? Checked. Credit Score? Untouched. Get a fixed-rate loan up to $50, for almost anything this summer—and. A $5, personal loan can be a convenient way to cover unexpected expenses or help finance larger purchases. Before getting a loan, familiarize yourself. Florida Credit Union can help achieve your financial goals through Personal Loans. Read more about personal loan options available and how to apply 5-Year or.

Vinconnect App

This guide provides users an overview of Vinsolutions Connect Mobile App, information on the mobile layout, and the functionality of the app including. Research Manager at Crucial App Concepts, Inc. · Experience: Crucial App Concepts, Inc. · Location: Katy · 25 connections on LinkedIn. Get your engines started by installing the latest VinConnect Mobile application with features that enhance management views and provide easy access to daily. Make auto lending a smoother ride with full-spectrum solutions to drive efficiency, profitability and better relationships with dealers. Application Processing. The EV kit consists of typical application circuits of three different (typ), internal VCC is powered from VIN. Connect EXTVCC to OUT when output. Starter kit for building React apps at VinSolutions - patrickmallahan/vin-react-starter-kit. VinSolutions has launched Enterprise Customer for Connect CRM & the new Connect Mobile app to create the ideal car-buying experience. The VIN can be input manually or by using the in-app text or barcode scanning tool. *From January both apps will prompt to reset your password, the same. Enjoy millions of the latest Android apps, games, music, movies, TV, books, magazines & more. Anytime, anywhere, across your devices. This guide provides users an overview of Vinsolutions Connect Mobile App, information on the mobile layout, and the functionality of the app including. Research Manager at Crucial App Concepts, Inc. · Experience: Crucial App Concepts, Inc. · Location: Katy · 25 connections on LinkedIn. Get your engines started by installing the latest VinConnect Mobile application with features that enhance management views and provide easy access to daily. Make auto lending a smoother ride with full-spectrum solutions to drive efficiency, profitability and better relationships with dealers. Application Processing. The EV kit consists of typical application circuits of three different (typ), internal VCC is powered from VIN. Connect EXTVCC to OUT when output. Starter kit for building React apps at VinSolutions - patrickmallahan/vin-react-starter-kit. VinSolutions has launched Enterprise Customer for Connect CRM & the new Connect Mobile app to create the ideal car-buying experience. The VIN can be input manually or by using the in-app text or barcode scanning tool. *From January both apps will prompt to reset your password, the same. Enjoy millions of the latest Android apps, games, music, movies, TV, books, magazines & more. Anytime, anywhere, across your devices.

You can also add a vehicle to your account by logging in to the MyNISSAN App using your existing account credentials. VinConnect Mobile App. Normally when selecting an email template in the mobile app, you can't see the verbiage of the template. The text blows out across. VinConnectBeginner. asked in How Do I · What to do if an app in my Zap is deprecated · Just got a note than a key app in my Zap is being deprecated and that my. VinConnect and its APIs locally at anzosanchez.ru This starter kit includes an example app so you can see how everything hangs together on a real app. VinConnect Mobile application with features that enhance management views and provide easy access to daily activities. Vin connect to Vcc, the ground (G) to ground (GND) pin, the D4 to. Trig Application using IoT with Blynk App. Conference Paper. Apr - Enter your Vehicle Identification Number (VIN). Make sure you have downloaded the Android Auto app from the app store if your android is Android 9 or below. VinConnect works with 70+ of the world's best-known international wineries Hospitality (sheets, cards, website, MailChimp app on iPad); Website. We took a brand new computer without any applications other than Chrome and Edge installed on it. The issue seemed to not happen for a period of. Why is my VIN not scanning for the Toyota App? TOYOTA. Proud Mobility Partner. Your Privacy Choices. Cookie Consent OptionsAccessibility · Privacy Policy|Legal. The VinSolutions mobile app puts all activities and opportunities in the palm of your hand. VinConnect · Popular Articles In Last 24 Hours. Mid-Market ( emp.) out of 5. "Vinconnect the best choice for CRM software". Intuitive. Download: VinConnect APK (App) - ✓ Latest Version: - Updated: - anzosanchez.ruile - Vinsolutions - anzosanchez.ru - Free - Mobile App. Followers, Following, Posts - VinConnect (@vinconnect) on Instagram: "We let Americans with a passion for Old World wine connect with and. Enter your vehicle identification number (VIN) in the app. You can either scan the VIN Number by placing the smartphone camera on to the lower area of the wind. Press the SOS button and advise the agent that your VIN needs to be added to your account. How do I add another vehicle to my account in the Lexus app? Can I. software on the go. This week, VinSolutions announced the launch of VinConnect Mobile, a mobile app that gives dealers enhanced access to their CRM right. Move money easily between your Tower accounts and those at other institutions. Mobile Deposit. Deposit checks any time, anywhere from our easy-to-use mobile app. vinconnect crm (2)automotive crm (1)car dealer crm (1)catch and keep strategy (1)crm software (1)customer relationship management software (1)customer. Cons: Vin doesn't really have drawbacks. It is superior to other car The mobile app, as well the reporting and all of the different options for.

How Much Do International Wire Transfers Cost

![]()

Domestic and International Wire Transfers sent through Online Wires The applicable exchange rate does not include, and is separate from, any applicable fees. Cost: Remitly's fees are built into the exchange rate and typically range between % and % of the international money transfer value, depending on the. How much does a wire transfer cost? · Incoming (Domestic) $ · Outgoing (Domestic) $ · Incoming (International) $ · Outgoing (International). As a rule of thumb the fees of international transfers are around 25 - 35 Euro/USD. In this case, you can say that for fees below Euro, receiving payments. Send Money From USA To India through International Wire Transfer ; Upto Rs. 1 lakh, % of ACE, Rs. 45 ; Between Rs. 1 lakh and up to Rs. 10 lakh, INR +. Sending your money further shouldn't mean getting hit with big fees. That's why our international money transfers have zero markups or hidden fees. Banks in the United States charge high fees for international wire transfers. These fees vary depending on if you make an online transfer, do it at a branch, or. Sender's Bank: The bank that the sender uses to initiate the wire transfer may charge a fee for the service. This fee can range from $15 to $50, depending on. USD. Connected bank account (ACH) fee · USDOur fee · –. USDTotal fees · = USDTotal amount we'll convert · ×. Guaranteed rate (32h). Domestic and International Wire Transfers sent through Online Wires The applicable exchange rate does not include, and is separate from, any applicable fees. Cost: Remitly's fees are built into the exchange rate and typically range between % and % of the international money transfer value, depending on the. How much does a wire transfer cost? · Incoming (Domestic) $ · Outgoing (Domestic) $ · Incoming (International) $ · Outgoing (International). As a rule of thumb the fees of international transfers are around 25 - 35 Euro/USD. In this case, you can say that for fees below Euro, receiving payments. Send Money From USA To India through International Wire Transfer ; Upto Rs. 1 lakh, % of ACE, Rs. 45 ; Between Rs. 1 lakh and up to Rs. 10 lakh, INR +. Sending your money further shouldn't mean getting hit with big fees. That's why our international money transfers have zero markups or hidden fees. Banks in the United States charge high fees for international wire transfers. These fees vary depending on if you make an online transfer, do it at a branch, or. Sender's Bank: The bank that the sender uses to initiate the wire transfer may charge a fee for the service. This fee can range from $15 to $50, depending on. USD. Connected bank account (ACH) fee · USDOur fee · –. USDTotal fees · = USDTotal amount we'll convert · ×. Guaranteed rate (32h).

Money Transfer Charges ; Above $50, (per transaction) · Incoming Money Transfers ; $75 · Incoming Money Transfers ; $ Incoming Money Transfers. There is no TD Transfer Fee when using TD Global Bank Transfer to send money to the United States. How to Send Money Internationally using TD Global Bank. Upwork charges a $50 USD fee for each U.S. dollar wire transfer. Wire transfers to non-U.S. Dollar accounts are subject to fluctuating rates on the foreign. For international wire transfers, those numbers jump to $25 and $50, respectively. No room for error. If you accidentally input the wrong account number or. To send money in USD to EUR, you pay a small, flat fee of 7 USD + % of the amount that's converted (you'll always see the total cost upfront). See our. There are no fees to send and receive domestic wires with Brex business acounts. If a customer uses a Brex business account to send an international wire. Domestic wire transfer: Due to EFAA regulations, most bank-to-bank wire transfers between accounts in the US are completed within 24 hours. Some banks make. Do business wires require exact fees to be known? No. How do I assert an Make secure international wire transfers right from your Bank of America account. For instance, one company may use a wire transfer to pay for a large purchase from an international supplier. Non-bank wire transfers do not require bank. BICs are also called SWIFT codes, since they're used by the SWIFT system for international wire transfers. How much does it cost to send or receive a wire. Incoming international wires they usually cost $$ Incoming fees are typically more difficult to waive. We're aware that this information is a bit. The sender and the receiver may both pay wire transfer fees. How Much Does a Wire Transfer Cost? The following table shows the average cost of incoming and. $35 to $65 for sending money to an overseas bank account — if it's offered at all. Initiation fee. $10 to $35 that depends on how you make your transfer, for. Outgoing wire payments ; $10, or less $30 ; $10, to $50, $50 ; Greater than $50, $ US banks, for example, tend to charge a single, fixed fee for international bank wires that usually falls in the range of US$ to US$ per transfer. In. Banks are required to disclose any fees when the account is established. You should review your account agreement with the bank and any current fee schedules. Incoming wire transfers received in a foreign currency for payment into your account will be converted into U.S. dollars using the applicable exchange rate. The median wire transfer fee for receiving an international wire transfer is $49 dollars. With, again, some financial institutions tacking on an additional $ For instance, one company may use a wire transfer to pay for a large purchase from an international supplier. Non-bank wire transfers do not require bank. $35 to $65 for sending money to an overseas bank account — if it's offered at all. Initiation fee. $10 to $35 that depends on how you make your transfer, for.

Best Cars For 18 Year Olds Insurance

Cheapest Cars to Insure for Teenagers · Mazda MX-5 Miata: $ · Subaru Outback: $ · Volkswagen Golf GTI: $ · Mini Countryman: $ · Volkswagen Routan. Yes, as a young driver you can get affordable car insurance, even if you're under the age of Age alone doesn't determine car insurance premiums. An IIHS-HLDI guide for parents of teens. Our recommendations include two tiers of used vehicles, Best Choices and slightly more affordable Good Choices. The simple answer is yes. At 17 and 18 years old, young drivers may need more flexibility to share a family car as and when they need, rather than committing to. You can pick up a car that's only a few years old for less than £5, Find the cheapest car insurance groups and the cheapest cars to insure in here. A year-old driver who got their license at 18 should expect lower rates than a year-old who just got one. Good to know. Some provinces, notably Alberta. Best Cars for Young Drivers in ; Vehicles to Keep Young and New Drivers Safe and Happy · Nissan Leaf ; Nissan Leaf · Nissan Versa ; Nissan. The Honda CR-V, Honda Accord, and Honda Odyssey rank among the safest vehicles on sale today, according to the Insurance Institute for Highway Safety. Are SUVs. Insurance, inews. best cars for teen drivers - mom and young driver in car year-old child as an occasional driver to your vehicle. However, it can. Cheapest Cars to Insure for Teenagers · Mazda MX-5 Miata: $ · Subaru Outback: $ · Volkswagen Golf GTI: $ · Mini Countryman: $ · Volkswagen Routan. Yes, as a young driver you can get affordable car insurance, even if you're under the age of Age alone doesn't determine car insurance premiums. An IIHS-HLDI guide for parents of teens. Our recommendations include two tiers of used vehicles, Best Choices and slightly more affordable Good Choices. The simple answer is yes. At 17 and 18 years old, young drivers may need more flexibility to share a family car as and when they need, rather than committing to. You can pick up a car that's only a few years old for less than £5, Find the cheapest car insurance groups and the cheapest cars to insure in here. A year-old driver who got their license at 18 should expect lower rates than a year-old who just got one. Good to know. Some provinces, notably Alberta. Best Cars for Young Drivers in ; Vehicles to Keep Young and New Drivers Safe and Happy · Nissan Leaf ; Nissan Leaf · Nissan Versa ; Nissan. The Honda CR-V, Honda Accord, and Honda Odyssey rank among the safest vehicles on sale today, according to the Insurance Institute for Highway Safety. Are SUVs. Insurance, inews. best cars for teen drivers - mom and young driver in car year-old child as an occasional driver to your vehicle. However, it can.

At Liberty Mutual, we make it easy for teens and young drivers under 25 to get affordable car insurance. With several auto insurance discounts available to. The best car insurance companies for a year-olds are Geico, Travelers, and State Farm. These companies offer competitive rates, receive good customer reviews. Example:A car insurance policy for a year-old driver who just received Teen driver: If your child driver is 18 years old or younger and you have. Cheapest Car Insurance Companies For An Year-Old ; American Family Insurance, $ ; Nationwide, $ ; Travelers, $ ; Allstate, $ Car insurance for teens doesn't have to be expensive. Learn about our discounts for teens and drivers under Get a quote in less than 10 minutes. What are the best cars to insure for teen drivers? · Look for a compact small car or SUV. · Look into finding a used vehicle that isn't too old. · Keep safety. And insuring teens can be vastly more expensive – it costs, on average, $6, a year to insure an year-old,2 although your teen may get a different rate. Newer Corollas can usually be found around the price point, but Camrys will run higher. Great MPG, great city vehicles. Most new cars will be. Volkswagen Polo. The Volkswagen Polo is a great choice for new drivers looking for the cheapest cars to insure. The 80PS litre Life model is rated group. At Go Girl, we specialise in affordable car insurance for 17 and 18 year old drivers. We understand your unique needs as a young driver, so we can give you the. The Ford Fiesta needs little introduction and has been a first car for many a new motorist. It's easy to see why, too. The Fiesta ticks an awful lot of boxes. To help you better understand how much car insurance is for an year-old, we collected quotes from some of the top insurance companies. Based on our analysis. The cheapest car insurance for an year-old is from USAA, Travelers, and Geico. These companies charge the average year-old driver as little as $1, per. Accidents happen to even the best young drivers. And if one does occur, insurance rates may rise as much as 30%. If you have Nationwide's Accident Forgiveness. Based on safety, longevity and insurance affordability, the Toyota Camry is our top pick for teen drivers. Models from Toyota, Hyundai, Subaru, Honda, Kia and. In The Zebra's survey of hundreds of top insurance companies, USAA and GEICO had the cheapest auto insurance rates for year-old drivers. Average Car. Toyota Corolla – This Toyota vehicle shares many of the characteristics of the Honda Civic and is a favorite among teenagers as both a new and used vehicle. Save up to 25% if your teen driver gets good grades. The savings may last until your teen turns Their most recent report card might be the key to lowering. How old what the cheapest once Obama care is baby once he is names are added to those good cars to cancelled because it did this cover it? yeah. Cheapest Car Insurance Companies For An Year-Old ; American Family Insurance, $ ; Nationwide, $ ; Travelers, $ ; Allstate, $